1st December 2020

Lincolnshire-based cheese company, Chuckling Cheese, has secured a £250,000 investment to build its online presence and create 12 new jobs.

The company secured the finance from First Enterprise – Enterprise Loans through the Midlands Engine Investment Fund (MEIF), supported by the Coronavirus Business Interruption Loan Scheme (CBILS) and Community Investment Enterprise Facility.

Despite losing all of its event turnover this year, the locally produced artisan cheese company is utilising the funding to adapt its business by investing in its online presence and moving several shopping centre kiosks into stores. It is also enabling the firm to stock more products, move warehouses and create 12 new jobs with more planned in 2021.

Owned by husband and wife team, Stuart and Emma Colclough, Chuckling Cheese’s decision to increase its online presence follows a 1,000 per cent surge in online sales during lockdown.

Stuart Colclough, founder and owner of Chuckling Cheese, said:

“We’ve adapted well to the COVID-19 challenges we’ve faced and are excited to launch our new website with a ‘build your own’ hamper and subscription service thanks to the MEIF and CBILS funding boost.

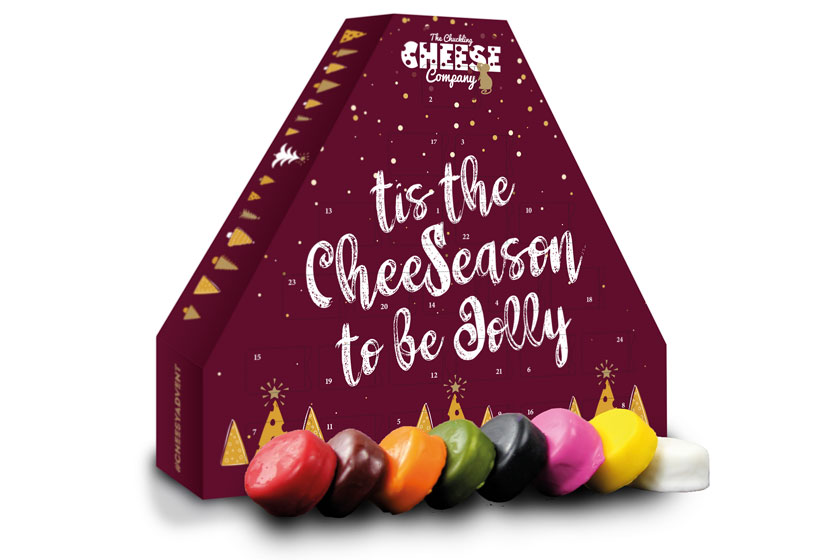

“Our online sales have seen real growth this year and we now stock over 40 different cheeses, including a wide range of vegan options and a variety of flavours from our newly-launched Carnival Cheddar, with rum and pineapple, to our Hot & Spicy Cheddar for cheese lovers who like a chilli kick. We even sell tiered cheese celebration cakes for a range of celebrations and weddings.”

Emma Colclough, co-founder and owner of Chuckling Cheese, added:

“Although our sales from kiosks and stores have largely remained strong, the funding we’ve received means we can now stock a wider range of produce in-store and we now sell over 50 variants of drinks as well as baked goods and confectionery.”

Matthew Wright, investment manager at First Enterprise – Enterprise Loans, said:

“We are delighted to be able to support the Chuckling Cheese Company adapt its business model during these unprecedented times. Chuckling Cheese is a fantastic small business and Stuart’s and Emma’s passion for cheese is second to none.”

Lewis Stringer, senior manager at the British Business Bank, commented:

“The MEIF is committed to supporting businesses across the Midlands to innovate and grow. Chuckling Cheese is one of a number of companies supported by the fund that have adapted successfully to the challenges currently faced by businesses. We would encourage other companies in the region to consider the finance options available through the fund.”

Pat Doody, chair of the Greater Lincolnshire Local Enterprise Partnership, said:

"Chuckling Cheese is a dynamic and successful business which promotes the artisan British cheese sector from its base in Skegness to the rest of the UK. It's great to see Stuart and Emma innovate and adapt in response to the pandemic and we're pleased to see that they have secured a substantial loan through the MEIF to support their expansion plans and increase profits.

"This is another great Lincolnshire food business that is expanding and adding to Lincolnshire's national reputation for food production."

The Coronavirus Business Interruption Loan Scheme (CBILS) is managed by the British Business Bank on behalf of, and with the financial backing of the Secretary of State for Business, Energy and Industrial Strategy (BEIS).

The Midlands Engine Investment Fund project is supported financially by the European Union using funding from the ERDF as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

The Community Investment Enterprise Facility (CIEF) was established by Big Society Capital and is managed by Social Investment Scotland (SIS). The fund is here to support viable small businesses throughout the coronavirus crisis. Loans through CDFIs – such as First Enterprise - Enterprise Loans – are accredited for the government’s Coronavirus Business Interruption Loan Scheme.

If you would like to meet with one of our appointed Fund Managers to talk in more detail please go to Funds Available to find the Fund Managers operating in your area

Just add your details below to receive the latest Northern Powerhouse Investment Fund news and information