10th February 2021

A Stamford based chocolatier business has secured a £250,000 MEIF loan to help meet increasing demand for its products from the UK and overseas. This is alongside boosting its marketing campaigns to drive sales in 2021.

Firetree Chocolate secured the finance from The FSE Group Debt Finance Fund, part of the Midlands Engine Investment Fund (MEIF) and backed by the Coronavirus Business Interruption Loan Scheme (CBILS).

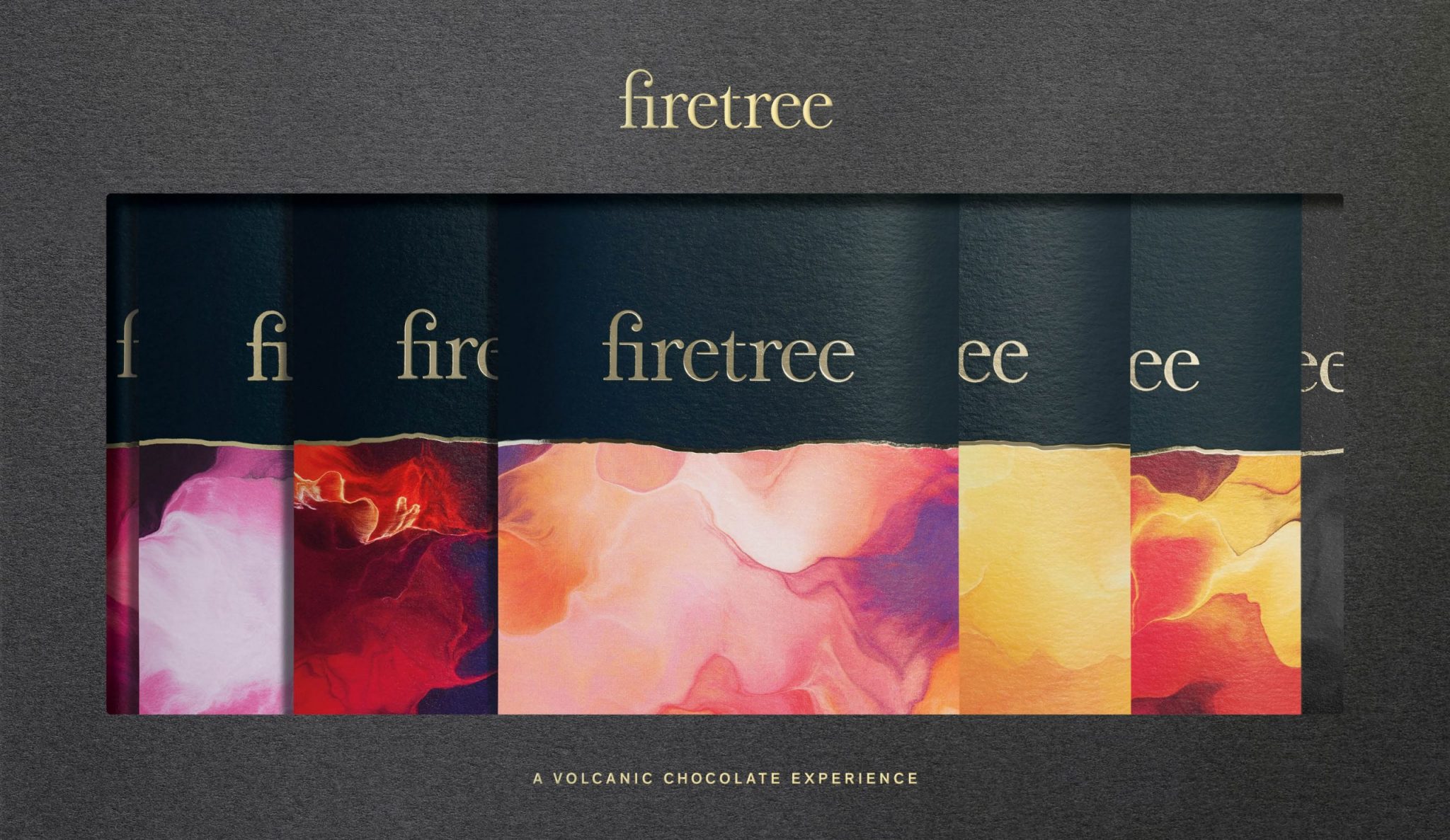

Incorporated in 2016, Firetree Chocolate aims to become the top UK luxury brand of premium craft chocolate. The company manufactures, from bean to bar, rich volcanic chocolate and focuses on sourcing and sustainability. The company sources cocoa beans direct from farmers in the remote volcanic islands of the South Pacific and Madagascar, where the volcanic minerals produce a unique bean and taste. The beans are imported to the UK and crafted into chocolate by expert chocolatiers at its factory, before being wrapped in packaging depicting the volcanoes from where the beans were sourced.

Firetree Chocolate’s products are all dairy free and suitable for Vegans, Halal, Kosher and those with lactose intolerance.

David Zulman, Co-Founder and Managing Director of Firetree Chocolate, commented:

“Although Firetree, along with other businesses, has been operating differently during the pandemic, we have adjusted well to the new normal and are encouraged to see demand for our product increasing. We take immense pride in what we do, working closely and directly with our farmers and creating single estate super-premium quality chocolate to delight our consumers. I would like to thank Paul at The FSE Group for helping us through the funding process which will assist in supporting the day-to-day sales, distribution and operations process whilst we plan ahead for an exciting future.”

Paul Lynam, Fund Manager, at The FSE Group, which manages the MEIF Debt Finance Fund adds:

“We are proud to have supported Firetree throughout this process. The loan will support David and the team in their ambitions to continue to develop the brand and increase sales into 2021 and beyond. The FSE Group is committed to providing finance for innovative Midlands-based businesses and we wish them well for the future.”

Lewis Stringer, Senior Manager at the British Business Bank said:

“The MEIF offers a range of funding options which can be used to support different business needs. Having previously secured an equity investment from MEIF fund managers Foresight Group, this latest funding package for Firetree Chocolate will play a key role in the business improving its operations. We would encourage other Midlands’ businesses to consider the finance available through the MEIF.”

Pat Doody, Chair of the Greater Lincolnshire Local Enterprise Partnership, said:

"It's exciting to see Firetree Chocolate opening new premises in Greater Lincolnshire in Stamford and investing heavily in its operations and marketing capacity.

"The Firetree brand is a fantastic addition to an already long list of high-quality food producers in Greater Lincolnshire and we are watching their progress with interest.

"We would encourage all innovative and ambitious businesses in our area to consider the Midlands Engine Investment Fund if they are look for finance to help them grow and innovate."

The Midlands Engine Investment Fund project is supported financially by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

The Coronavirus Business Interruption Loan Scheme (CBILS) is managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy and industrial Strategy (BEIS). Deadline for CBILS applications has been extended to 31st March for UK businesses.

If you would like to meet with one of our appointed Fund Managers to talk in more detail please go to Funds Available to find the Fund Managers operating in your area

Just add your details below to receive the latest Northern Powerhouse Investment Fund news and information